The ACCC has prioritized a crackdown on drip pricing, which is where a price is advertised without the add-on extras payable at the checkout.

Drip pricing is a marketing strategy used in online sales. A low headline price is advertised to attract customers. Extras are then added during the online purchase process. The extras might be booking fees and service fees. They are added gradually or at the end, and are part of the total price payable at the checkout / payment stage.

Drip pricing is a misleading pricing practice in breach of the Australian Consumer Law. According to the ACCC: “Customers are sometimes lured into purchases they would not otherwise have made (or into paying more than they intended to) when businesses display only part of the price upfront and reveal the total price only towards the end of the purchasing process” ACCC Deputy Chair Catriona Lowe said.

In the past 7 months, the ACCC has pursued Dendy Cinemas and Webjet for drip pricing practices.

Dendy pays penalties for alleged ‘drip pricing’ practices

(ACCC media release 25 June 2025)

Dendy Cinemas operates 52 screens across six cinemas in NSW, QLD, and the ACT.

The ACCC alleges that Dendy failed to prominently show the total price of movie tickets it sold online as a single figure at the time of first stating the price. Not until the end of the online purchasing process did Dendy show a per ticket booking fee was payable. This was misleading because only part of the total price for a movie ticket was displayed on the webpage inviting the booking.

The ACCC issued Dendy with an infringement notice and Dendy Cinemas has paid a $19,000 penalty.

The ACCC says it is looking at pricing practices in the cinema industry more broadly to ensure that per ticket booking fees are being presented in a way that complies with the pricing obligations under the Australian Consumer Law.

Webjet alleged to have made misleading claims about airfare prices and flight bookings

(ACCC Media Release 28 November 2024)

Webjet is part of the listed Webjet Group Limited. It operates the online travel agent arm of the company, manages the Webjet brand, and carries out marketing operations via email and social media.

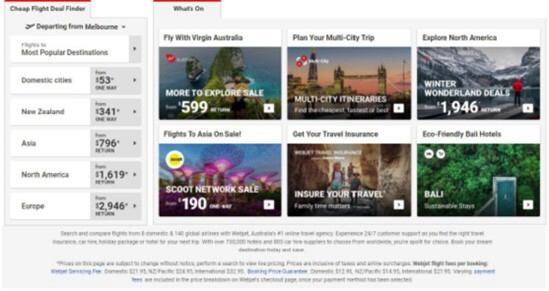

Webjet’s app and website offer travel-related products and services to consumers, including from different airlines. Consumers can compare and book flights, hotels, car rental and travel insurance through the Webjet website and app.

The ACCC alleges that Webjet made statements about the minimum price of airfares which omitted compulsory fees charged by Webjet (the “Promoted Price”). The statements included “flights from $x” when the price quoted excluded Webjet’s compulsory ‘Webjet Servicing Fee’ and ‘Booking Price Guarantee’ fee. For Domestic Flights the fee was $34.90 consisting of $21.95 for the Webjet Servicing Fee and $12.95 for the Booking Price Guarantee fee. The total fees were $39.90 for NZ Pacific Flights and $54.90 for International Flights The fees were payable per booking.

The ACCC alleges that: “The Price Representations were false, misleading deceptive or likely to mislead or deceive because all bookings had Webjet Fees added to the Promoted Price and it was therefore not possible for any consumer to purchase a promoted flight from Webjet for the Promoted Price.”

Webjet was more sophisticated than Dendy in its drip pricing practice because the information about the Webjet fees was on the page where the Promoted Price was displayed - not hidden until later in the booking process. The information about the Webjet Fees was often asterisked and typically accessible by scrolling towards the bottom of the website page, app or email.

In the opinion of the ACCC, this did not make the Webjet fees sufficiently clear or prominent. “Although some Promoted Prices were accompanied by an asterisk, information about Webjet Fees was not displayed on the Webjet app, Webjet website or emails in a sufficiently clear, prominent or proximate manner to neutralise the false, misleading or deceptive effect of the Price Representations. Further, the social media advertisements did not contain any information about the Webjet Fees.”

The ACCC has commenced proceedings against Webjet in the Federal Court of Australia for declarations and orders under sections 18(1) and 29(1)(i) of the Australian Consumer Law for misleading conduct and representations as to the price of services.

The proceedings were taken in the public interest on a consumer and competition level.

“We know how much Australian consumers value air travel to stay connected for work, leisure or to visit family. During this time of cost pressures, many consumers are carefully considering travel arrangements and seeking to save money. A statement about the lowest price must be a true minimum price, not a price subject to further fees and charges before a booking can be made,” ACCC Chair Gina Cass-Gottlieb said.

“Webjet obtained commercial benefits from the Price Representations by attracting consumers to its site on the basis of flight prices that were not attainable and then receiving additional payments through the compulsory inclusion of Webjet Fees. Webjet is also likely to have gained an advantage over its competitors to the extent that the conduct made Webjet’s airfares appear more attractive than they actually were.”

Comment

Drip pricing has been an ACCC target for many years. In 2015, I was bold enough to post an article on Lexology headed There’ll be no more drip pricing by Airbnb and eDreams in Australia and in 2016 an article headed There’s to be no more drip pricing of booking fees since the Jetstar decision. How wrong was I to declare ‘mission accomplished’?

The ACCC sees Misleading surcharging practices and other add-on costs as a significant consumer issue and the ACCC has made it an enforcement and compliance priority in 2025-26.

“We encourage all businesses to review their online pricing practices to ensure they are … providing the total minimum quantifiable price of products and services in their advertising and at the earliest opportunity in their booking process” ACCC Deputy Chair Catriona Lowe said in the 25 June 2025 Media Release.

Example of Webjet website showing promoted prices for Cheap Fight Deals “from $x*”

Marketing Commentary by Michael Field from EvettField Partners

Systematic Consumer Deception at the Expense of Consumer Trust

What fascinates me about the recent ACCC crackdown on drip pricing isn’t the legal precedent or the consumer outrage; it’s the silent erosion of brand equity through systematic deception at the expense of consumer trust. The individual transactions are not large-scale scams, but rather repeated small acts of consumer deception, embedded in the customer experience, and delivered at scale.

When marketers prioritise tactical revenue extraction over transparent value exchange, they undermine the very trust that brands work so hard to build. In a digital ecosystem where brands must function as ecosystems of trust, and customers are just one screenshot away from turning whistleblower, this kind of pricing behaviour is reputational suicide in slow motion. The customer may complete the transaction, but the brand exits the relationship poorer, not richer.

This isn’t just a “marketing” problem; it’s a failure of compliance and governance oversight. A symptom of a deeper misalignment between brand promise and organisational conduct. Boards and executive committees should see pricing transparency as a leading indicator of cultural health; much like safety reporting in industrial firms. When the marketing team gets too “clever” with margin mechanics, what’s really at play is a short-termism that signals weak leadership oversight.

Governance should ask: Is our pricing designed to delight and inform, or to trap and extract? The answer to that question defines whether you’re building customer lifetime