Key points

- The ACCC investigated whether Coles and Woolworths used land banking as a strategy to block competitors from acquiring sites in the same locality.

- The ACCC found that Coles and Woolworths have competitive advantages when they acquire and hold sites for supermarkets.

- But the ACCC will not investigate whether Coles and Woolworths are currently land banking undeveloped or unused sites because it’s too complex to assess.

- The ACCC identified local planning and zoning laws as barriers to entry and recommended that all levels of governments free up retail sites for competitors.

- The ACCC will “closely scrutinise future acquisitions by Coles and Woolworths”.

The ACCC report is Supermarkets Inquiry Final Report (Section 3.10).

This is analysis using extracts from the Report, followed by a marketer’s perspective.

ACCC Executive Summary - Barriers to entry and expansion

“Coles and Woolworths have advantages in securing suitable retail sites due to their significant size, reputation and financial resources. As a consequence, their rivals find securing retail sites challenging.

Coles and Woolworths frequently purchase and hold land for future development. This has formed the basis for allegations they are engaging in “land banking”.

Coles and Woolworths currently hold more than 150 undeveloped and unused sites intended for future supermarket use.” [p 12-13]

Coles and Woolworths have advantages when acquiring sites

“Coles and Woolworths have competitive advantages and are often the most likely to be successful in acquiring suitable sites over other supermarket operators [because they]:

- have strong reputations as good tenants

- can act as major (or anchor) tenants in shopping centres across Australia

- can offer landlords higher rents

- have the capital and resources to open new stores in undeveloped urban regions or growth corridors where store development occurs in anticipation of population reaching levels supporting a supermarket

A consequence of Coles’ and Woolworths’ competitive advantages in acquiring retail sites is independent supermarkets may find it challenging to compete for these sites [and] more broadly, the scale and competitiveness of independent supermarket chains may also be inhibited.

It appears Woolworths is filling a demand for well-located [small format] stores [such as CBD Metro] that allow for convenient top-up style shopping. This may be concerning if [it] results in the removal of a smaller, independent competitor from the area.” [p 159-160]

Coles and Woolworths have an entrenched position in Australia’s supermarket industry due to their established retail store networks

“In our view, the length of Coles’ and Woolworths’ leases reinforces their market positions [and this is] unlikely to change dramatically in the medium to long-term.

This is because convenience is a key driver of store choice for consumers and having a supermarket in a good location gives a strong competitive advantage in that local area. [Also] there is often also a shortage of suitable sites for rival supermarkets to enter a local area.

Coles submitted that 99% of its stores are leased. We understand around 80% of Coles’ leased stores have more than 10 years remaining on their leases (if all options to extend are exercised).

Woolworths - more than 90% of its leased stores have more than 10 years remaining on their leases (if all options are exercised).” [p 160]

Planning and zoning laws can lead to delays and may prevent new entry or expansion in local areas

“Our [the ACCC’s] view is planning and zoning laws may overly restrict the overall supply of suitable sites. Our understanding is:

- zoning limits the locations where supermarkets may operate and

- planning leads to delays to, or at times complete inability for retailers or developers to develop sites.” [p 154]

“Coles submitted if a site is complicated to develop, for example if rezoning is required, development or planning approvals are complicated or there are access or easement issues that require resolution, land may be held for lengthy periods.

Woolworths submitted that in NSW: the rezoning process generally takes between 2 to 5 years; and the development application process generally takes between 1 to 2 years.” [p 156]

The ACCC identified reasons for delays “include:

- The site is complicated to develop

- The site is in undeveloped urban regions or growth corridors where development is not required until population growth is at a level to sustain a supermarket

- Parcels of land are too small to develop and require acquisition of contiguous sites

- Protracted liquor licensing approval processes or contamination clean up of the land

- Competing capital priorities or revisions to business plans and sales projection

- A smaller format store is more appropriate

- Construction delays due to escalating costs” [p 164]

The ACCC made this recommendation:

“Governments should adopt measures to address planning and zoning issues”

“We recommend all levels of government adopt measures to simplify, streamline and harmonise planning and zoning laws across jurisdictions, to the extent possible. Doing so would reduce barriers to entry and expansion for all competitors”. [p 171]

Comment: Zoning and planning delays are identifiable as risks in due diligence pre-acquisition for a property. The recommendation is a distraction from the issue of whether Coles and Woolworths are engaged in a strategy of land banking as a barrier to entry sand extension by competitors.

Coles and Woolworths compete aggressively for, and have advantages over others in securing retail sites, which creates risks for competition

“Acquisitions by Coles and Woolworths lead to a lack of access to suitable sites. The ACCC focused upon 3 types of alleged conduct namely:

- land banking

- oversupplying local areas

- acquiring shopping centres in which competitors are operating.

Information received from Coles and Woolworths during this inquiry, combined with our views below, indicate there is a need for the ACCC to closely scrutinise future acquisitions by Coles and Woolworths.

This is particularly the case given our views that Coles and Woolworths have:

- competitive advantages in acquiring and securing suitable sites

- an entrenched position in Australia’s supermarkets industry due to their established retail store network.” [p 158-159]

Are Coles and Woolworths land banking?

“For the purpose of this report, we adopt this definition of land banking:

purchasing land without an intention to develop that land (or earlier than needed to develop that land) so as to block competitors from developing land in these locations.

- Coles holds 59 undeveloped or unused sites intended for future supermarket use.

- Woolworths holds 105 undeveloped or unused sites intended for future supermarket use.

- By comparison, ALDI holds 17 undeveloped or unused sites for future supermarket use.

[the sites are both freehold and leasehold sites]

In submissions to the inquiry and during the public hearings, Coles and Woolworths denied engaging in our definition of land banking. For example:

- Coles said it has a finite balance sheet, and only wants to invest in properties that are going to deliver a return. It said it purchases land to put a supermarket down, not to sit idle.

- Woolworths submitted that it acquires relevant sites only with the intention to develop new stores (or expand or refurbish existing stores) or online fulfilment capacity for its own business.

Determining whether purchasing and holding of any piece of land is anti-competitive, including by preventing a rival’s entry or creating strategic barriers to entry or expansion, is a complex assessment requiring detailed analysis on a case-by-case basis.

Local market conditions need to be examined, including (but not limited to):

- the distance to the nearest rival supermarkets

- the nature of consumer demand in the area

- the rate of population growth

- availability of alternative sites nearby

- likely entry or expansion by rivals

- reasons for any delay to development.

We have not conducted this case-by-case assessment as part of this inquiry. Given the confines of the inquiry, we also did not observe Coles and Woolworths engaging in a deliberate or overarching strategy of land banking.” [p 160-161]

Comment: No recommendation is made by the ACCC to undertake a case-by-case assessment of the undeveloped and unused sites currently held by Coles and Woolworths to determine if they are land banking. It’s all too hard! This can only be viewed as a major “win” for Coles and Woolworths.

The new mergers regime will improve our ability to scrutinise acquisitions

“There is a need for the ACCC to closely scrutinise future acquisitions by Coles and Woolworths. This is particularly the case given our views that Coles and Woolworths have:

- competitive advantages in acquiring and securing suitable sites

- an entrenched position in Australia’s supermarkets industry due to their established retail store network.” [p 161]

Currently Australia’s merger laws do not require mandatory notification of acquisitions.

Incoming merger reform including a potential Ministerial instrument (which introduces further notification requirements for supermarkets) will enhance the ACCC’s ability to scrutinise acquisitions by supermarkets. A case-by-case assessment of acquisitions by Coles and Woolworths was outside the scope of this inquiry.” [p 158-159]

The ACCC Case Study

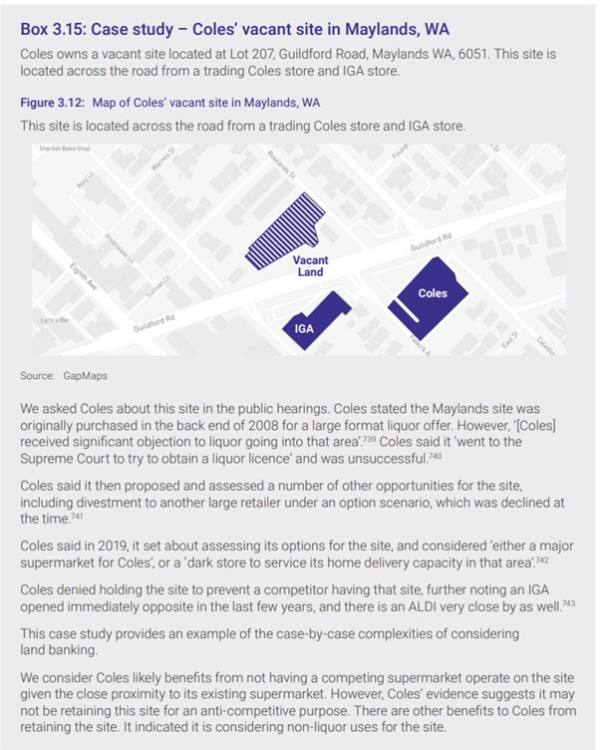

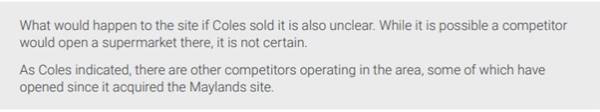

The report contains this Case Study on land banking.

“This site shows why it is necessary and often complicated to assess the competitive impact of undeveloped and unused sites.” [p 165]

[p 166-167]

Marketing commentary by Michael Field from EvettField

“How Supermarket Giants Like Coles and Woolworths Play the Property Game—And Why Smaller Players Need to Play to Their Strengths”

From a marketing perspective, the property teams within major supermarkets like Coles and Woolworths operate within a legitimate strategic framework designed to secure growth opportunities and enhance competitive positioning. Their approach to site acquisition and development reflects prudent corporate planning, leveraging their financial resources, reputation, and capabilities to secure prime retail locations.

Smaller competitors, like ALDI and IGA, face inherent challenges due to limited capital and resources. Their success is dependent on building strong customer relationships, curating tailored product ranges, and providing a hyper-localised service experience. ALDI, for example, focuses on simplicity and efficiency, offering a streamlined product selection at attractive prices. Whereas IGA plays to its strengths in local community engagement and responsiveness.

While it is appropriate for smaller players to advocate for regulatory oversight, achieving competitive advantage requires innovating beyond direct competition for prime retail sites. You must play to your strengths.